Managing inventory costs is a constant balancing act. Carrying too much inventory ties up cash. Carrying too little can lead to missed sales opportunities. That’s why striking the right balance is the key to maximizing sales potential and profitability.

Take control of your inventory costs and fulfillment processes. Get started with our comprehensive Ware2Go’s ebook for expert tips and strategies.

That’s where managing your inventory costs comes in. It’s not just about counting stock — it’s about boosting your bottom line.

But let’s face it: Calculating costs gets tricky, especially with multiple suppliers, distributed inventory, and multiple sales channels.

Don’t worry!

This guide breaks down inventory cost tracking and its types, how to calculate it, and whether you deal with one supplier or a hundred. Learn to set better budgets, avoid common mistakes, and tips on keeping costs low.

What Are Inventory Costs?

Inventory costs, or the cost of inventory, encompass the expenses tied to storing, ordering, and managing stock. The three main categories are ordering, holding, and stockout costs. Effective inventory management isn’t easy, but with the right technology and strategic partnerships, it can level up your business and streamline your operations.

Importance of Tracking Inventory Costs

Tracking inventory costs is essential for maintaining healthy profit margins, maximizing return on investment, and freeing up working capital. Understanding inventory costs enables more strategic decision-making around marketing strategies, sales channel prioritization, procurement, and more.

Categories and Types of Inventory Costs

Ordering Costs

Ordering costs include expenses related to procurement and manufacturing. It may be tempting to think only of the cost of the actual purchase of goods, but ordering costs give a much more holistic picture of the cost of procuring inventory. They include:

- Cost of Goods: Calculated as unit price multiplied by quantity, optimized with Economic Order Quantity (EOQ) for efficiency.

- Invoicing Costs: Expenses and fees related to requisitions and purchase orders.

- Goods Processing Costs: Labor and supplies associated with sorting, labeling, and packaging goods.

- Moving/Transportation Costs: Expenses from vehicle use and maintenance, fuel, and labor.

- Insurance Fees and Taxes: Protection and taxation costs for goods in transit.

Holding or Carrying Costs

Holding costs are the expenses incurred while storing inventory. They are highly variable based on your risk tolerance for stockouts and inventory turnover rate. Optimizing inventory carry costs is one of the most effective levers to pull for increasing profitability. Examples of holding costs are:

- Capital Cost: Calculated using Weighted Average Cost of Capital (WACC), capital cost is the initial expense for setting up storage.

- Handling Costs: Expenses associated with the movement of goods, including equipment and labor.

- Storage Space Costs: Include rent, utilities, maintenance, and labor. These costs can be fixed or variable depending on whether you build out capabilities in-house or outsource with a flexible fulfillment provide

- Taxes and Insurance: Costs associated with protecting stored goods and taxes that will vary according to state policies where the product is stored.

- Obsolescence Costs: Costs associated with damaged, spoiled, and outdated inventory. These costs can be controlled with regular inventory cycle counts, automated expiry date tracking, and inventory management protocols like LIFO or FIFO.

Stockout Costs

Stockout costs represent lost revenue from missed sales opportunities due to unavailable or damaged goods. Stockout costs often have a knock-on effect of damaged seller authority on channels like Amazon and decreased paid advertising performance when ad spend is paused. And ultimately, the cost of re-engaging lost customers or rush ordering in order to restock may outweigh the cost of loss sales. Proper forecasting and inventory management can help avoid these losses.

How to Track Inventory Costs

Tracking inventory costs effectively is crucial for managing expenses throughout the supply chain, and a robust inventory management software is a valuable tool for monitoring every stage of inventory movement, from procurement to final mile delivery.

By automatically recording costs associated with purchasing, storing, handling, and shipping, these systems provide end-to-end visibility into all expenses associated with inventory. Additionally, a best-in-class inventory software will integrate with your entire tech stack, streamlining processes across accounting, sales, and fulfillment platforms. With this level of visibility, you can identify cost-saving opportunities, strike a balance between overstocking and stocking out, and make informed decisions to optimize their inventory management processes.

How to Calculate Inventory Costs

There are multiple methods for calculating inventory costs, including First In First Out (FIFO), Last In First Out (LIFO), and the Average Cost Method. .

- FIFO: Calculates based on the cost of oldest inventory and is more appropriate for perishable goods or for businesses looking to increase the value of inventory on their balance sheet.

- LIFO: Uses the cost of the newest inventory and is more appropriate for non-perishable goods or for businesses looking for the clearest and most current picture of costs vs revenue.

- Average Cost Method: Determines an average per-unit cost and is most appropriate for non-perishable goods and businesses looking for a stable and simplified method.

Factors That Might Affect Inventory Costs

It’s important to build flexibility into your inventory management plan to account for any unexpected expenses that may arise. Anyone who’s been in the retail business for any amount of time is no stranger to supply chain disruptions that can raise transportation and storage costs or lead to unforeseen losses. Below are some of the most common external factors that might unexpectedly influence inventory costs and create financial challenges:

- Delays in Transit: Extended transit times can be caused by inclement weather, labor shortages, port congestion, and more. The more time a product spends in transit, the greater the cost of moving it.

- Demand Fluctuations: Unexpected increases in demand lead to stockout costs, while sluggish demand leads to higher inventory carry costs.

- Accidents and Disasters: Recent accidents like the crash of the Ever Given and political unrest like the conflict in the Red Sea have led to increased costs across the supply chain.

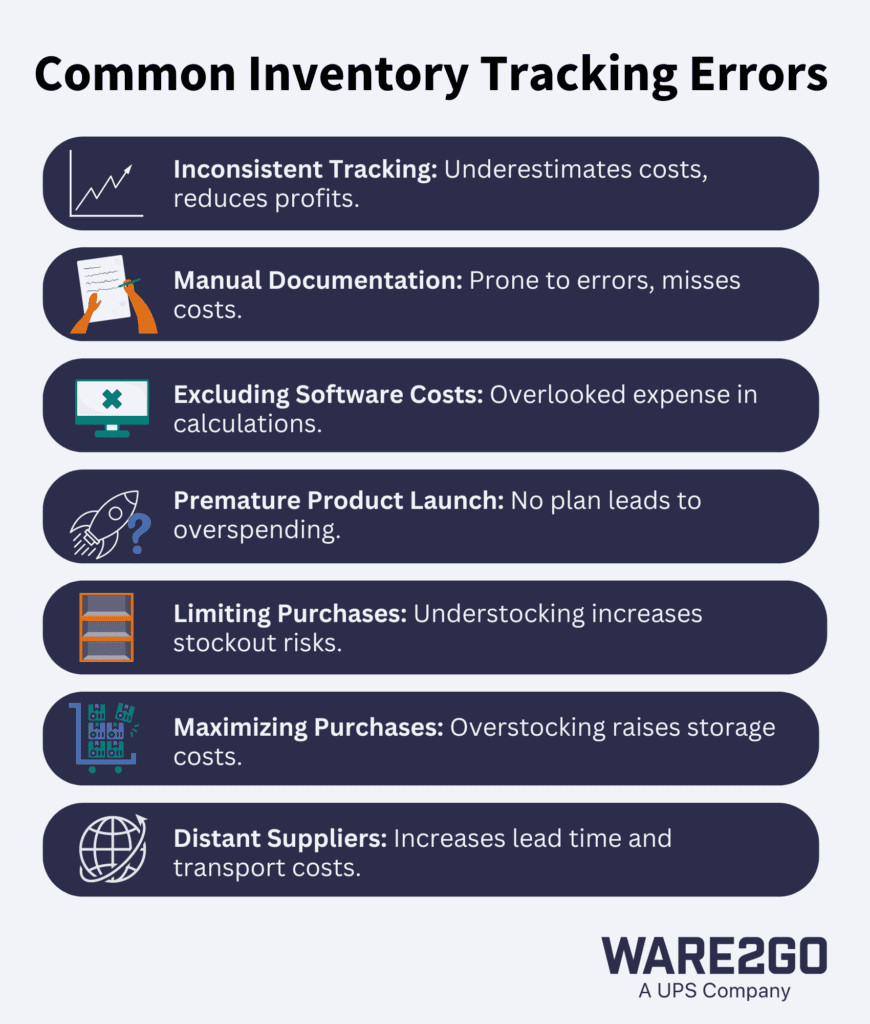

Common Inventory Tracking Errors

Accurate inventory tracking is essential for cost management and profit maximization, but common tracking errors can inflate expenses and reduce profitability. Here are seven inventory tracking errors that can lead to inaccurate results that ultimately damage margin.

Inconsistent Tracking

Inconsistent inventory tracking can lead to inaccurate records, which often results in underestimating actual inventory costs. For example, failing to update inventory counts after each sale or shipment can cause discrepancies between physical stock and recorded stock levels. Similarly, if restocking dates and costs aren’t recorded immediately, you could lose track of current inventory value, especially when prices fluctuate. That’s why it’s important to perform regular inventory cycle counts to ensure physical inventory counts match digital records, especially after promotional activities.

Another common inconsistency is neglecting to log returned or damaged items, which can inflate stock numbers and skew cost data. These tracking gaps mean that inventory expenses are not fully accounted for, potentially leading to unexpected costs and reduced profits. They can also lead to over-selling, creating a negative customer experience. Consistency in tracking helps maintain an accurate cost picture, which is essential for strategic decision-making.

Manual Documentation

Recording inventory costs by hand can easily lead to human error and overlooked expenses. Manual documentation is not only inefficient but also increases the risk of data loss or inaccuracies, ultimately impacting the reliability of the inventory cost calculations.

Rather than relying on manual documentation, consider leveraging an inventory management software to streamline data entry and automatically log inventory transactions to reduce the risk of human error and overlooked expenses. Automated systems make updates in real-time as inventory is ordered, received, and sold, ensuring that records are always current and accurate. Additionally, digital documentation centralizes all inventory data, minimizing the chance of data loss and allowing businesses to generate reliable reports quickly. By moving away from manual processes, you can improve the accuracy and efficiency of inventory cost calculations, and ultimately make better financial decisions.

Excluding Software Costs

A common oversight is excluding software costs when calculating inventory expenses. Many businesses invest in inventory management software, but don’t include the cost of licensing in cost evaluations. Digital services and subscriptions can quickly add up and weigh down operating expenses.

Launching Products Before Setting Up an Inventory Management Plan

Launching new products without a comprehensive inventory management plan can lead to excessive spending on inventory management. Without a plan, businesses risk inefficiencies, over-ordering, and inadequate storage, all of which contribute to higher costs and reduced profit margins.

That’s why influencer brand, 100 Thieves, aligned closely with their fulfillment partner, Ware2Go, before launching their new energy drink, Juvee. They worked with Ware2Go to ensure their inventory was positioned to meet their customers’ expectations for fast shipping and built a custom project plan to support their high-volume sales efficiently.

Limiting Purchases

While limiting purchases may seem like a way to reduce ordering costs, it often leads to stockouts. If demand exceeds supply, stockouts result in lost sales and customer dissatisfaction. Balancing purchase quantities helps maintain sufficient stock levels to meet demand without excessive stockout expenses.

Additionally, suppliers typically offer bulk discounts at various order quantities. It’s important to strike a balance between supplier discounts and inventory carrying costs to realize the highest margin and most efficient supply chain operations.

Maximizing Purchases

Conversely, over-purchasing might reduce ordering costs by taking advantage of bulk discounts, but it significantly increases storage costs and the risk of product obsolescence. Overstocking can lead to wasted goods, particularly for perishable items, and can tie up capital in unsold inventory, impacting cash flow and profitability.

Distant Suppliers

Working with distant suppliers can increase both lead times and transportation costs. Long lead times reduce flexibility and can lead to higher expenses, particularly if demand changes or emergency shipments are required. Selecting suppliers closer to the point of sale can help reduce these costs and improve response times. Recently, an increased interest in nearshoring has led to increased manufacturing in Mexico and increased import activity across the Mexico-US border.

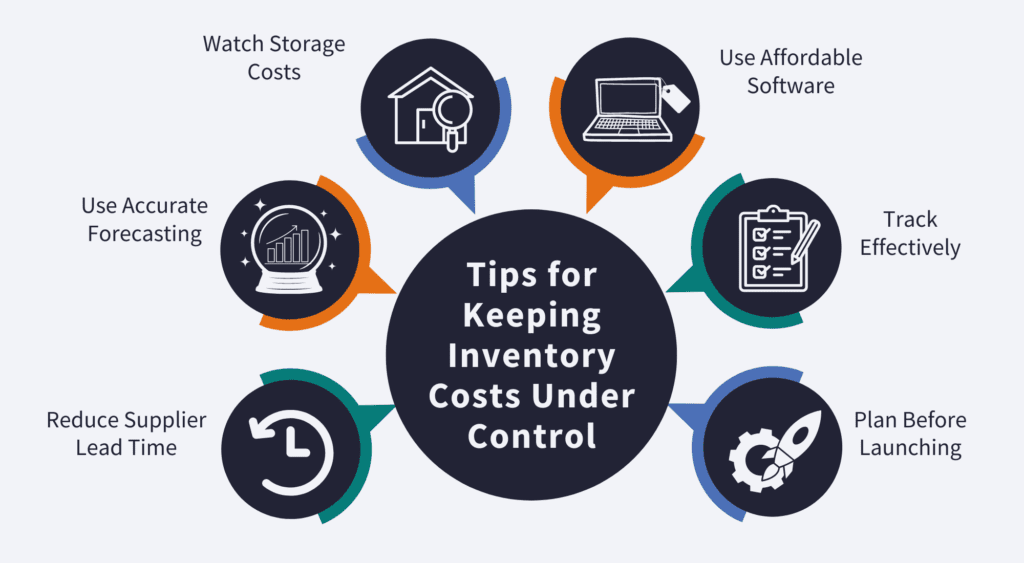

Tips for Keeping Inventory Costs Under Control

- Reduce Supplier Lead Time by choosing closer suppliers and building closer relationships with manufacturers.

- Accurate Forecasting to strike a balance between minimizing stockouts and over-indexing on storage costs.

- Watch Storage Costs by rationalizing your SKU catalog to prioritize top-moving SKUs and improve inventory turnover ratios.

- Use Affordable Software to avoid unnecessary expenses without sacrificing efficiency.

- Track Effectively to identify opportunities to reduce costs like decreasing time in transit (TNT) and prioritizing the right sales channels.

- Plan Inventory Management Before Launch to realize greater efficiency and ensure the best possible end customer experience.

Inventory Costs FAQs

- What Are Common Inventory Costs? Inventory costs include capital, ordering costs, storage, holding, and stockout costs.

- Importance of Inventory Costs? Inventory costs are more complex than just cost of goods and storage costs. Having a total landed view of inventory costs is essential for profitability and effective use of capital.

- What Are Carrying Costs? Carrying costs are expenses tied to storing inventory, which can be managed through effective inventory management and more strategic procurement strategies.

Scale Your Inventory Management With Ware2Go

You need to set a solid inventory management foundation to accurately track your inventory costs. An inventory management system that properly monitors every step of your inventory journey can help you see the expenses you are incurring and optimize your inventory costs.

Do you find doing all of this in-house overwhelming? Partnering with an inventory and warehousing management company like Ware2Go will provide you with reliable and secure inventory management so that your inventory costs never erode your profit goals.

To learn more about how Ware2Go helps retailers build happier, more profitable fulfillment networks, reach out to one of our fulfillment experts today.